White Label Solutions for PSPs & Acquirers

Become a Payment Service Provider (PSP) in as little as 3 weeks

Become a Payment Service Provider (PSP) in as little as 3 weeks

Our Solutions

Gateway

Mobile App

Management System

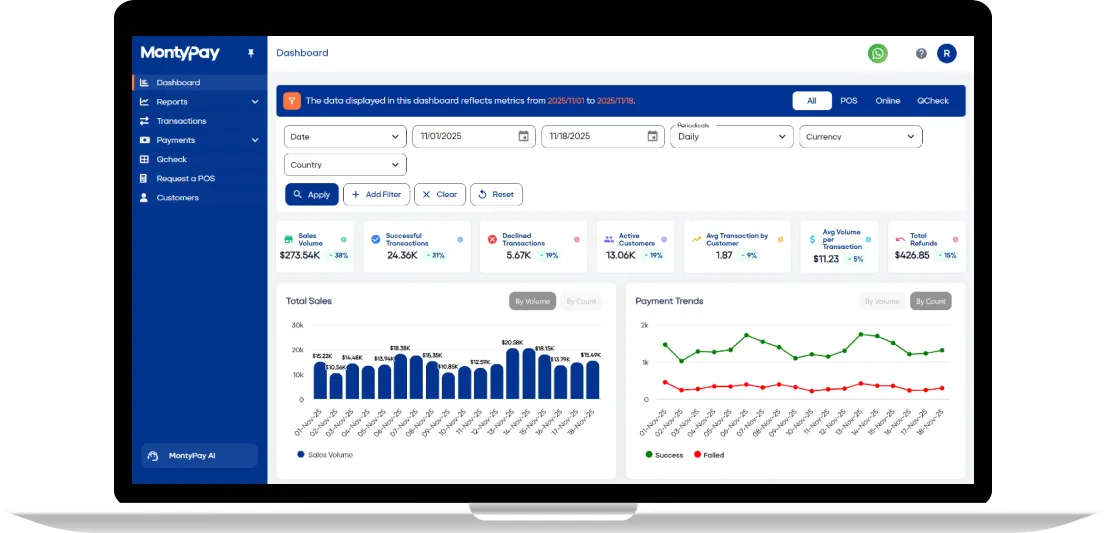

Centralized Data Management

QCheck

Our one-page, user-friendly data management tool consolidates all your payment channel data into a single, easy-to-navigate interface. This empowers you to maintain control over various payment channels through a unified access point, streamlining monitoring and management.

MontyPay's Merchant Management System offers you unparalleled control and efficiency.

Operational Control

Manage and monitor your operations effortlessly, streamlining tasks and processes for maximum efficiency.

Data-Driven Insights

Manage and monitor your operations effortlessly, streamlining tasks and processes for maximum efficiency.

Scalability

Access the tools needed to scale your business efficiently, adapting to your evolving needs.

Customization

Tailor the system to your unique business requirements, ensuring it aligns seamlessly with your brand identitys.

Our one-page, user-friendly data management tool consolidates all your payment channel data into a single, easy-to-navigate interface. This empowers you to maintain control over various payment channels through a unified access point, streamlining monitoring and management.

MontyPay's QCheck revolutionizes dining experiences.

Efficiency Boost

Enhance efficiency with seamless bill settlements, reducing table turnover time.

Bill Splitting

Streamline the bill-splitting process, making it easier for groups to divide expenses.

Increased Tips

Witness a significant increase in tips, providing a financial incentive for your staff.

Enhanced Reputation

Make your establishment the talk of the town with improved dining experiences.

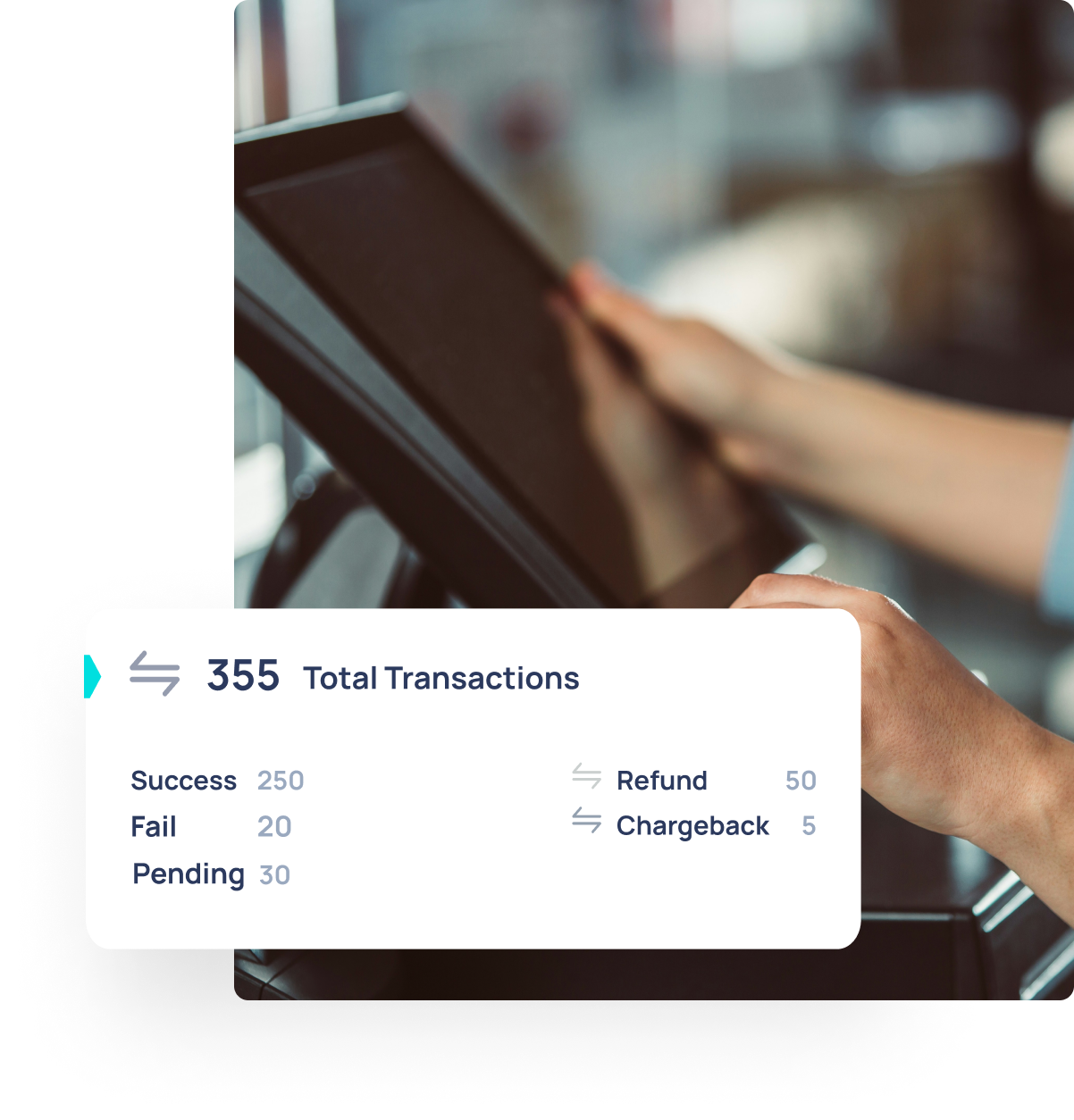

Merchant Mobile Application

Our merchant mobile application offers a seamless experience, providing access to comprehensive dashboard reporting and analytics. With this app, you can effortlessly:

Track transactions and monitor revenue

Send invoice links

Utilize the pay-by-link feature for convenient payments anytime, anywhere

Request support

Customize payment options based on client needs

Display QR codes for efficient payments at your physical location

Collect payments easily with the QR pay feature

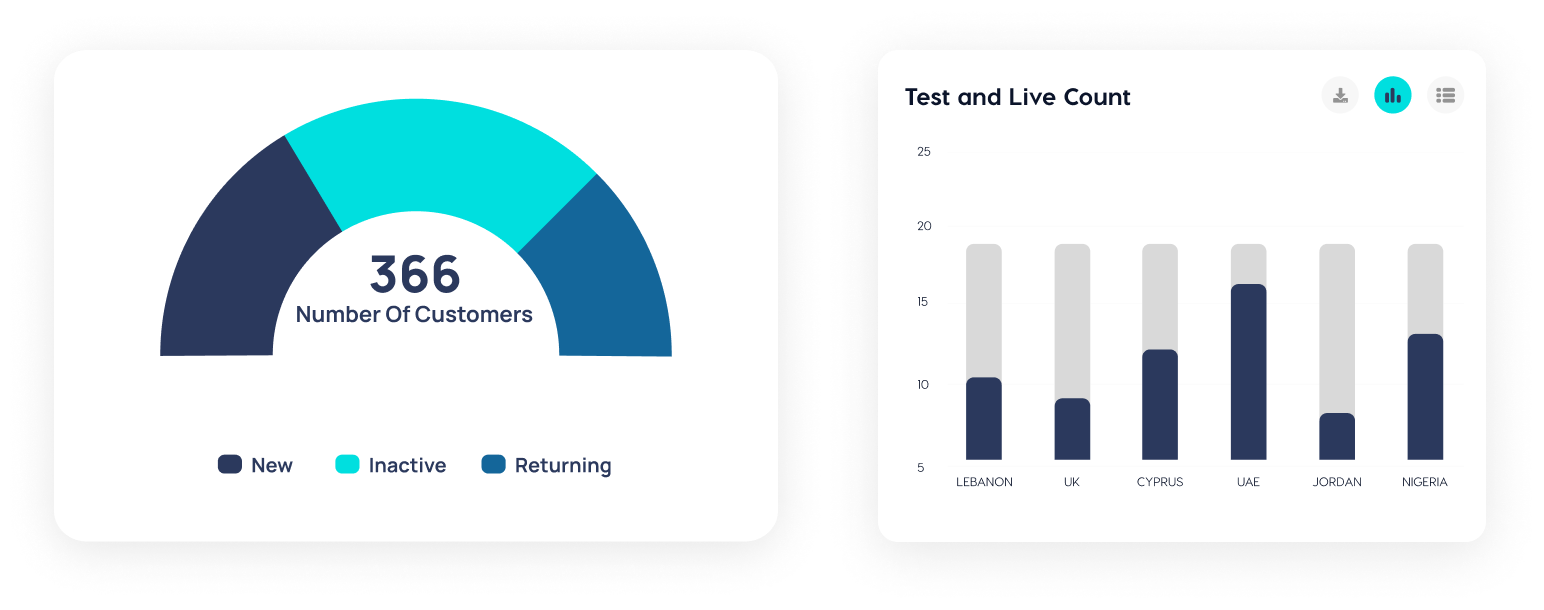

Efficient Data Insights

Gain valuable insights into your business operations with a centralized area for payments data, reporting, and more. Our rich reporting dashboard offers real-time analytics, transaction insights, and an intuitive interface. Multiple users and administrative roles further enhance your data management capabilities.

Global Payment Collection

Allow your merchants to collect payments globally and instantly through various channels, including telephone sales, email, social media, QR codes, invoices, and messaging. Our platform simplifies recurring and batch payments, streamlining your billing processes and reducing manual effort.

Flexible Billing and Settlement

Customize fees for individual transactions with our premium billing platform features. Easily calculate commissions, merchant settlements, and referral partner rewards, all within a single platform.

Intelligent Routing

Identify cost-effective transaction routes and routes with higher acceptance rates. MontyPay's transactional traffic routing considers multiple factors such as currency, transaction origin,3D-Secure requirements, and more. This intelligent routing optimizes acquirer performance and enhances transaction success.

Live Chat Support

Our live chat customer support is available around the clock to address any customer queries, ensuring a seamless and responsive service experience.

Risk Management

MontyPay employs an advanced risk management system that combines in-house and external scoring models to detect, analyze, and prevent potentially fraudulent transactions. Our anti-fraud modules, external risk scoring providers, 3D-Secure 2.0, and customizable anti-fraud plans work together to safeguard your business.

Cutting-Edge Technology

MontyPay leverages the latest technology to support your business expansion into new markets, increase revenue capture, and deliver a seamless checkout experience for your customers.

Expanded Connectivity

With over 170 connectors, MontyPay offers a wide range of pre-made links to banks and payment options, in addition to integrating your existing ones. This extensive network ensures a continuous flow of payments and simplifies integration with banks, retailers, and Alternative Payment Methods (APMs).